ePic Apps

Out-of-the-box, purpose-built apps to address crucial business functions.

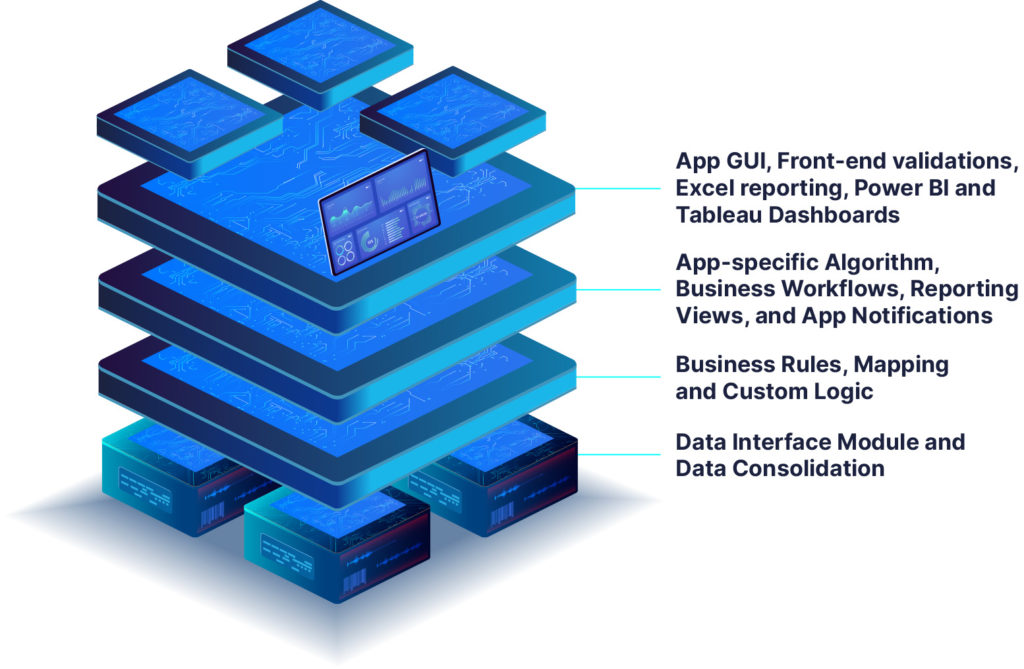

Framework

At the core, apps use EPIC’s underlying modules to pull data from external systems, process it and generate consumable outputs.

Output data can be displayed as dashboards, tabs, reports, or as interactive screens.

Access control is managed from EPIC’s centralized security module.

Benefits of Apps

EPIC is designed to scale as per the client’s specific needs.

The ready-to-use apps can be utilized as-is or customized.

Integrated with EPIC Platform

Create Custom Apps

Centralized Security Management

Subscribe to Individual Apps

Ease of Deployment

Timely Upgrades

Customizable

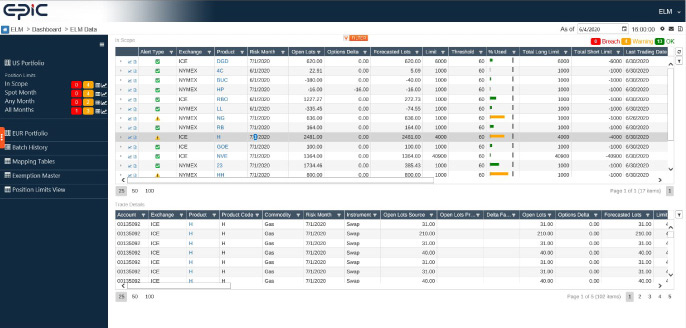

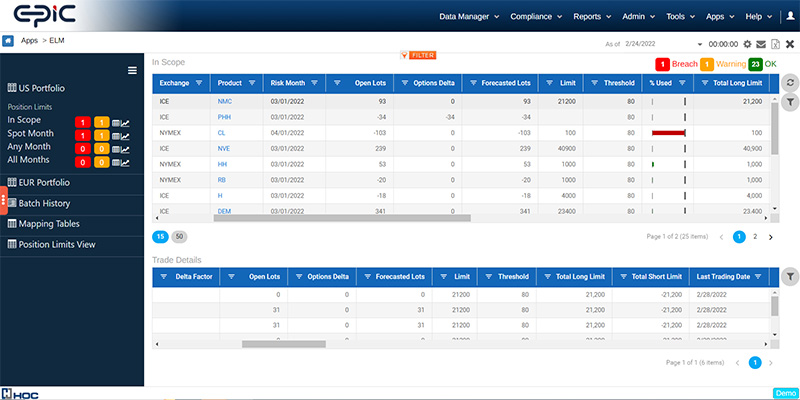

ELM (Exchange Limits Monitoring)

Monitoring exchange position limits presents challenges for trading firms. It involves maintaining limits, gathering trade data, calculating lots and applying rules. The ELM App enables near real-time monitoring of positions with a visual representation of positions, thresholds and breaches.

Features

- Real-time monitoring of ICE, CME and Nodal Exchange positions on a single screen

- Dashboard view and charts provide a near real-time view of all limit violations.

- Enables drill-down to the trade level

- Built-in Exemption Manager

- User-defined threshold limits per product

- Export all or selected positions to Excel with trade-level details.

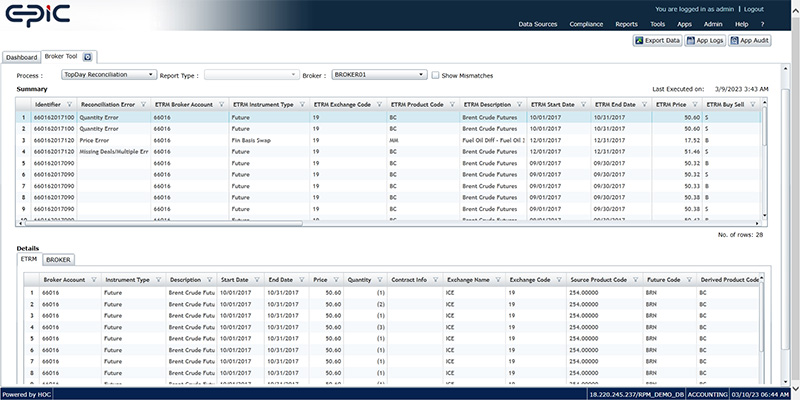

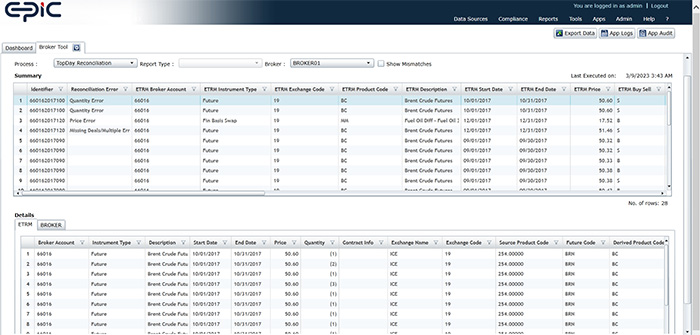

Broker App

The ready-to-use Broker App does the majority of the heavy lifting your organization needs for trade compliance and reporting.

Features

- Connects to broker portals and aggregates the information in one place

- Reconcile intra-day and end-of-day trade attributes with positions in internal trade capture systems to those reported by brokers.

- Calculate and reconcile broker fees. Reconcile multiple categories of broker fees and add more as needed.

- Calculate the Initial and Maintenance margin using the SPAN tools provided by ICE and CME as well as verify the broker invoices.

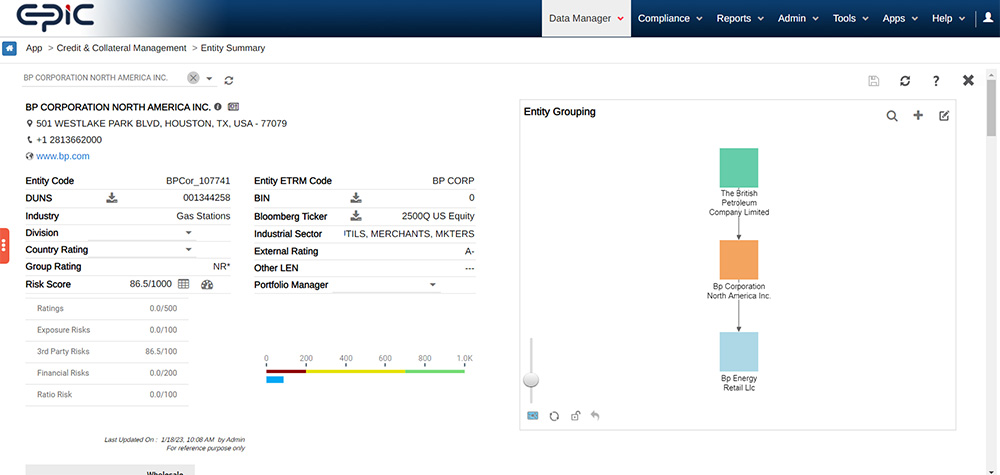

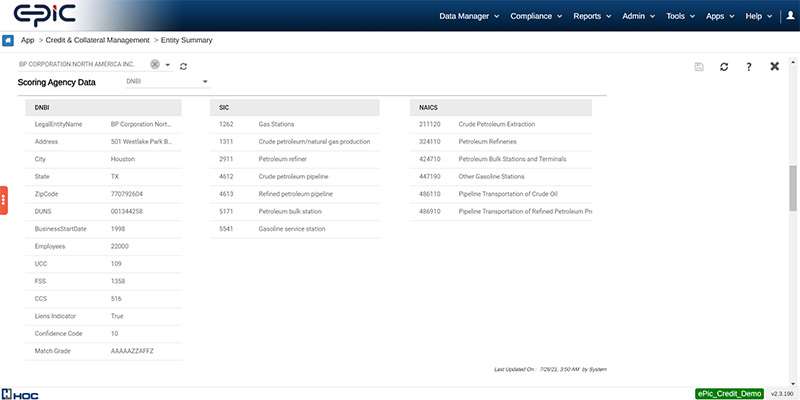

CPM (Credit Process Manager)

The CPM (Credit Process Manager) App is a collection of logically grouped modules that helps businesses make complex credit decisions. It’s a complete credit onboarding and adjudication automation solution that increases transparency and saves time.

Features

- Get control over the Credit Adjudication of External Entities across the enterprise.

- Manage all your Contingent and Non-Contingent Collateral.

- Automate your Bilateral and FCM Margin workflows.

- Create and apply your own Credit Risk Models.

- Inclusive Credit Risk Management. Connect to data sources for informed decisions.

- Reporting and Business Intelligence

- Interfacing capabilities with internal systems such as SAP, Siebel and more.

- Built-in capability to manage contracts, parental guarantees and surety bonds.

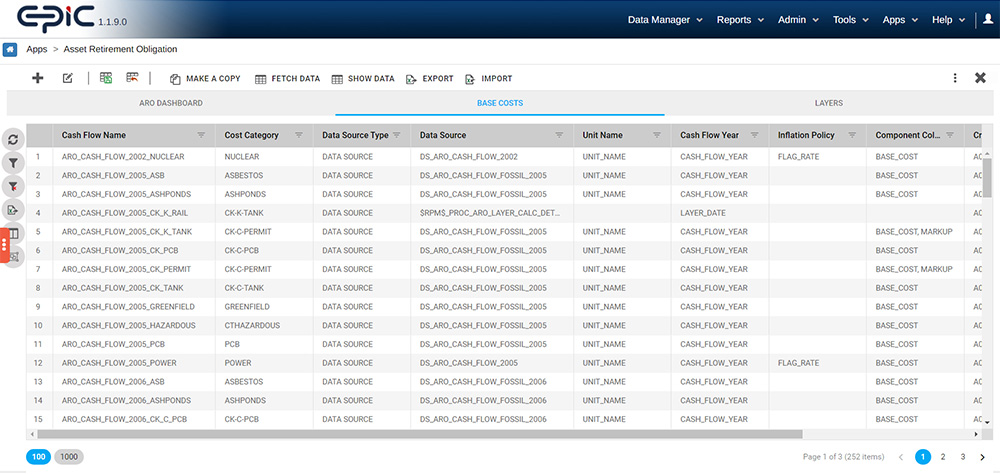

ARO (Asset Retirement Obligation)

The ARO (Asset Retirement Obligation) App makes it simple for you by providing a reliable, auditable and repeatable solution for your FASB 143 reporting requirements in a secure SQL Server database. AROs present a more accurate and holistic snapshot of the enterprise’s overall value and, therefore, should be included in a company’s financial statement.

Features

- Initial ARO / ARC and Data Upload: Allows easy data load into the system. The intuitive UI lets users create ARO scenarios within minutes, ensuring all relevant information is entered (with an audit trail and access control).

- Subsequent ARO Measurements and Layering: EPIC allows the user to create layers for individual assets in order to measure changes in liability due to the passage of time. Additionally, it allows for the handling of incremental changes to variables with cost fluctuations decreasing due to economic factors or expected life changes.

- Accounting Automation: EPIC leverages its powerful reporting and data interfacing layers to achieve accounting close automation around your ARO liability.

- Other Features: Layer locking with one-time passwords, periodic settlements and retirements, sensitivity analysis (what-if?) and user-defined ARO cost categories as well as asset types.