Asset Retirement Obligation (ARO)

ARO App makes it simple for you by providing a reliable, auditable and repeatable solution to your FASB 143 reporting requirements in a secure SQL Server database.

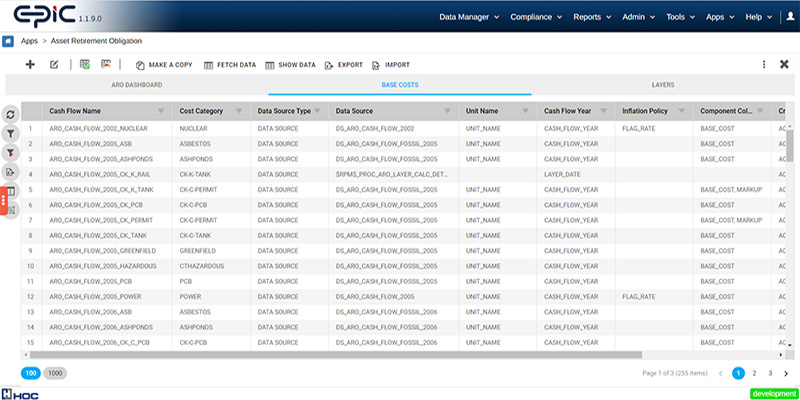

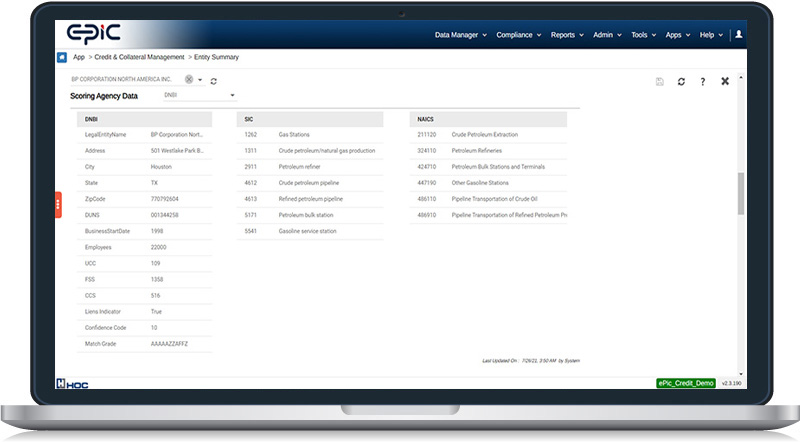

Initial ARO / ARC and Data Upload

EPIC’s robust data layer allows data to be loaded easily into the system. The intuitive UI lets users create ARO scenarios within minutes, ensuring all relevant information is entered (with audit trail and access control). Information such as future cash flows, upward and downward discount rates, cost probabilities and inflation rates can be uploaded manually or imported in an automated fashion from data providers.

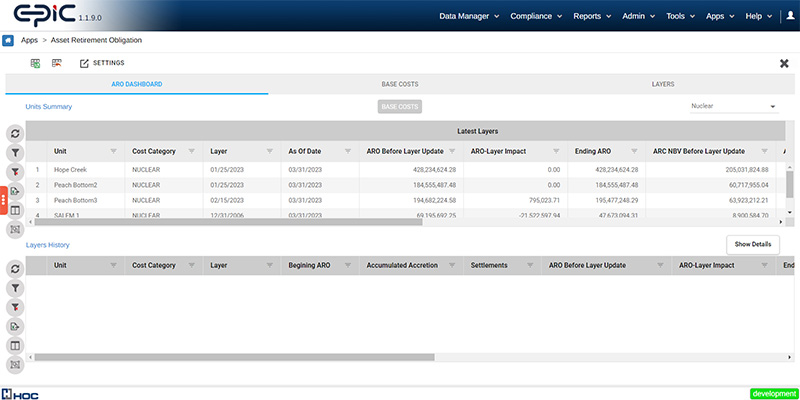

Subsequent ARO Measurements and Layering

EPIC allows you to create layers for individual assets to measure changes in liability due to the passage of time. It also allows you to handle incremental changes to variables such as when costs increase or decrease due to economic factors or expected life changes. All layer calculations are archived and easily accessible through the feature-rich UI of EPIC.

Accounting Automation

EPIC leverages its powerful reporting and data interfacing layers to achieve accounting close automation around your ARO liability. Reporting includes Accretion/Depreciation tables and Roll Forward for a fiscal period (by lease/property or individual ARO), Income statement and balance sheet activity and journal entries (with account numbers and cost centers for automated GL upload).

Other Features

Layer Locking with One-Time Passwords

Periodic Settlements & Retirements

Sensitivity Analysis

Cost Categories & Asset Type Maintenance

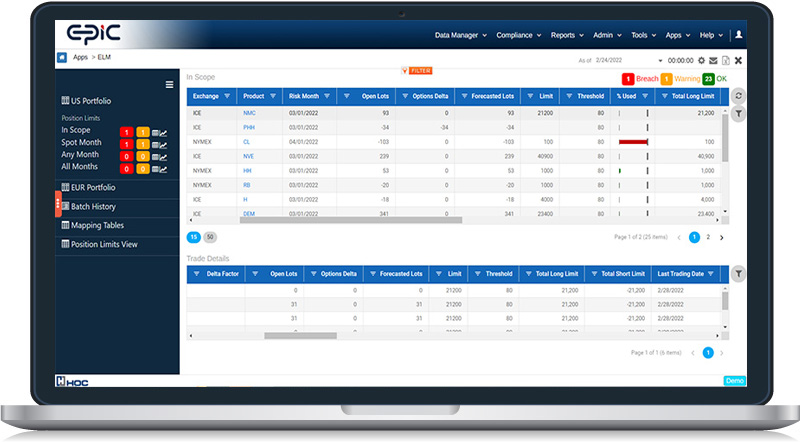

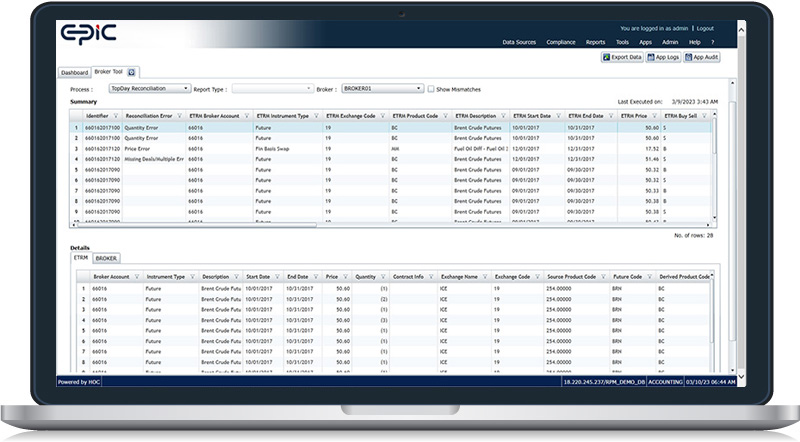

Plug-n-Play Apps

Purpose-built apps to support critical business functions from day one.