Credit Process Manager (CPM)

Comprehensive credit risk management solution

CPM is the tool you need to make complex credit decisions. Get a complete credit onboarding and adjudication automation solution that increases transparency and saves time. CPM was developed in collaboration with one of North America’s largest companies to assist them in realizing their vision of centralizing all credit workflows to mitigate risks across various business segments and visualizing the company’s aggregated exposure to all external parties.

Get More Control on the Credit Adjudication of External Entities Across the Enterprise

CPM has a fully automated workflow for submitting and approving a credit request for external entities. This workflow encompasses various business segments such as wholesale trading, retail and marketing as well as supply chain and procurement. All your exposures across all your lines of business can be monitored in CPM.

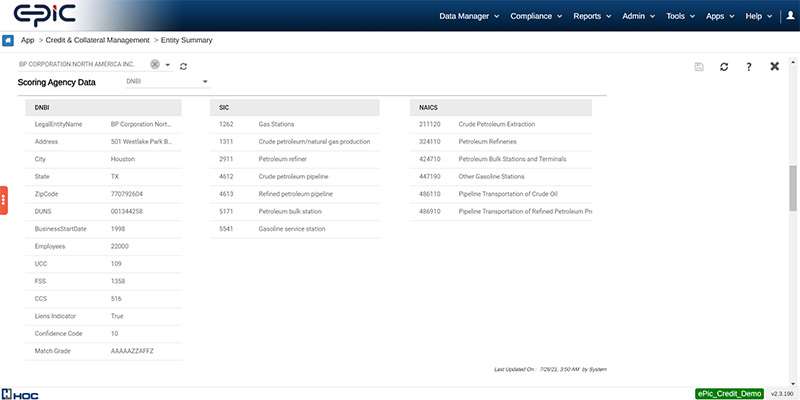

CPM will automatically download relevant information for the entity being adjudicated from sources like DNBi, Experian, Bloomberg, S&P, Moody’s and others. Then, the data is available to credit analysts and managers so they can make an informed decision on the credit limits and thresholds.

The Designation of Authority matrix allows you to automatically escalate credit approvals to senior management for less credit-worthy external entities.

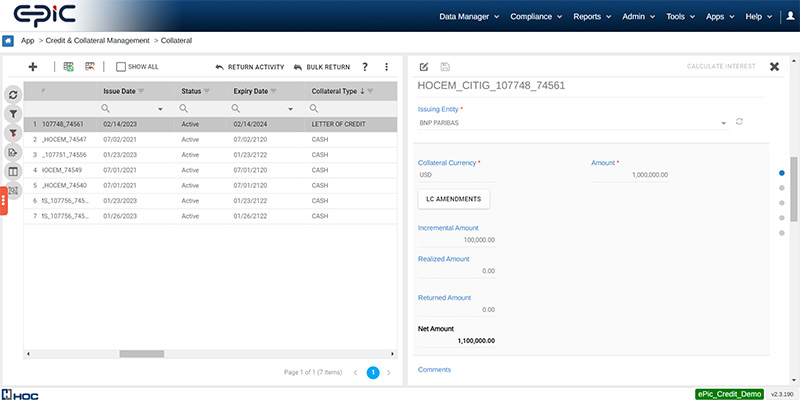

Manage All Your Contingent and Non-Contingent Collateral, Automate Your Bilateral and FCM Margin Workflows

CPM provides a comprehensive collateral management solution for all types of collateral and the daily management of margin calls. You can completely automate the creation of margin invoices and emails to counterparties. The margin module allows your team to store all historical margin calls, manage margin disputes and maintain an audit trail for all activities.

CPM’s collateral module gives you a feature-rich screen to store all Cash and Letters of Credit Collateral. CPM calculates the interest on cash held or given, as well as calculates Letters of Credit fees charged by banks. CPM also gives you the ability to manage all your Parental Guarantees and corresponding allocations at the contract level from a single screen.

Fully Configurable Credit Scoring Model

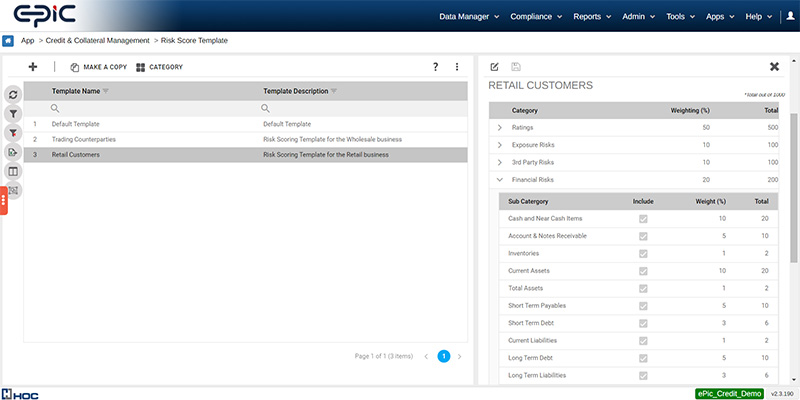

CPM has a flexible credit scoring module, which allows credit analysts to use multiple scoring templates. A more targeted credit risk evaluation model produces a better measure of risk. You can assign a single template to all external entities for the business segment, or you can have different scoring templates for different external entities based on their business types.

In addition to quantitative factors, you can also configure the coring model to consider qualitative factors, which are unique to your business. The final risk score can be used for counterparty credit reviews. All risk scores and corresponding quantitative and qualitative factors are available as intuitive reports and dashboards.

Connect to All Data Sources to Make an Informed Decision

Credit Risk Management cannot work in an isolated silo. CPM has out-of-box capabilities to make REST API calls to data providers like DNB, Bloomberg and Experian. In addition, the credit request workflow is seamlessly integrated with the data captured from these data providers to get valuable information on the external entity being reviewed.

CPM also provides outbound APIs for other systems in your enterprise to access CPM data and reports. The wealth of information captured by all inbound APIs is tagged and archived in EPIC’s data warehouse. All of this data is available via outbound APIs, thus allowing you to make CPM the one-stop-shop for all enterprise-wide risk data.

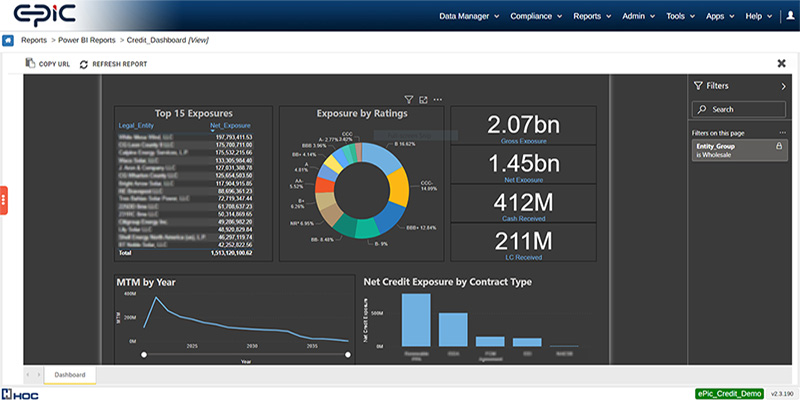

Reporting and Business Intelligence: We Have it All Covered

CPM utilizes EPIC’s power reporting engine to generate feature-rich and informative Excel reports for every credit data point in the system. CPM also comes with a set of intuitive and insightful dashboards, which are extremely useful in providing summarized and aggregated credit snapshots across multiple workflows.

CPM also integrates seamlessly with third-party BI engines like Microsoft Power BI and Tableau. CPM provides users with a one-stop-shop for viewing and editing all credit risk-related information as well as all qualitative and quantitative parameters, for all external entities with which you do business.

Other Features

Interfacing With SAP, Salesforce & More

Contracts Management

Parental Guarantees Management

Surety Bonds Management

Feature Rich Margin Workflow

Customizable Notifications, Alerts & Email Notifications

Fully Auditable Modules & Data Security

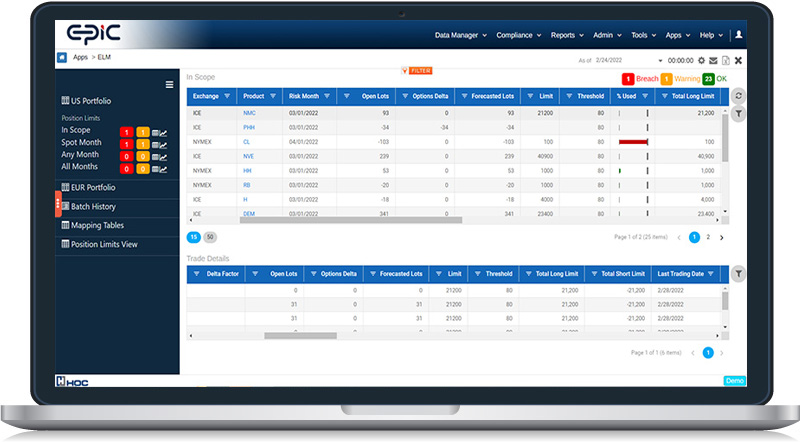

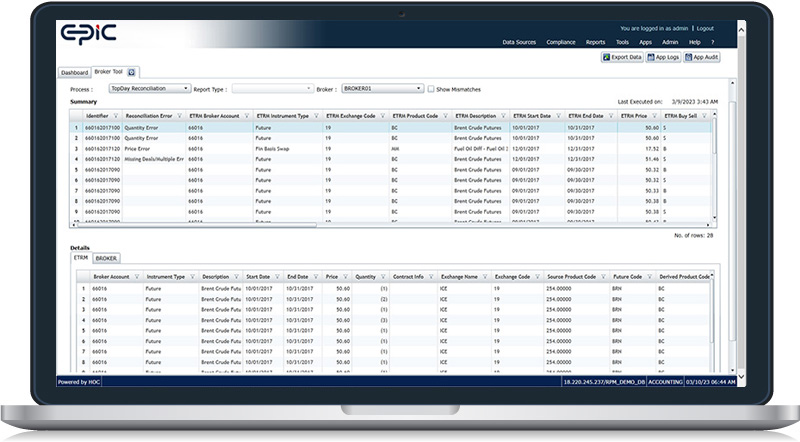

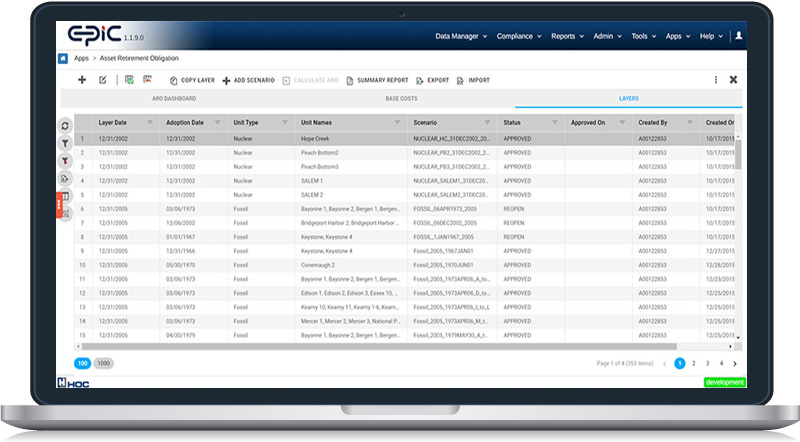

Plug n Play Apps

Purpose-built apps to support critical business functions from day one.