Trade Compliance

Simplifying trade compliance and monitoring.

EPIC helps you meet current compliance monitoring demands while capable of accommodating future changes.

In the Utility and Energy domain, continuous and complex changes in guidelines and protocols are the norm. Every organization is required to comply with statutory; internal compliance; laws; regulations set out by CFTC, FERC, FSA, FTC, SEC and other regulatory bodies. It is in this context that EPIC saves the day. An automated Compliance Monitoring platform, giving you an overall view of your compliance and acting as a risk mirror for your organization.

Key Features

Systems Integrations

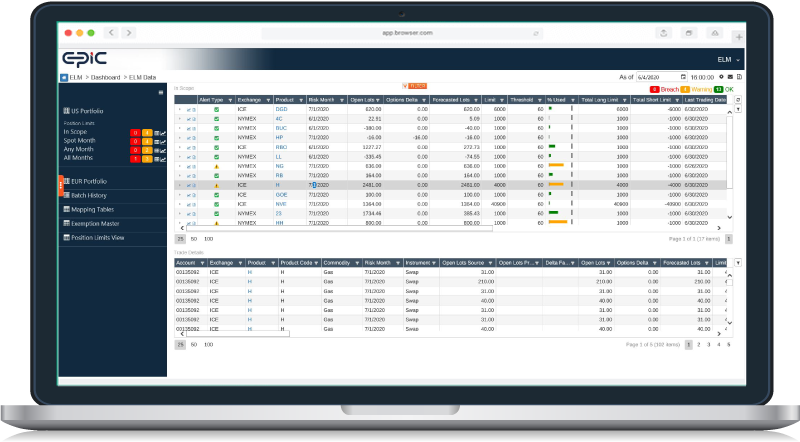

Built-in integration to the CTRM, ETRM systems. Powerful API and ETL engine. Integrated with Identity Access Management software such as SailPoint, CyberArk and others.

Issue Escalation Matrix

Out-of-the-box issue escalation matrix automatically notifies traders and their managers about the breach.

Auto Email Notifications

The smart emailing mechanism sends summaries and reports to the recipient besides batch status emails.

Custom Reporting Layout

In addition to the default Excel reporting, benefit from dashboards, BI Reports, delimited, PDFs to name a few.

User Defined Mappings

Define custom mapping tables that are auditable, applicable date-based and can be locked in safely.

Validations & Business Rules

Define configurable and auditable business rules to detect breaches with high transparency and flexibility.

Locking Sensitive Data

Prevent data and mappings from getting overwritten once the reports are finalized.

Workflow Integration

Automated workflow integration with workflow management software such as Wrike.

Secure & Auditable

Provides detailed audit trail on the configuration changes and mapping data changes. Highly controlled role-based security framework.

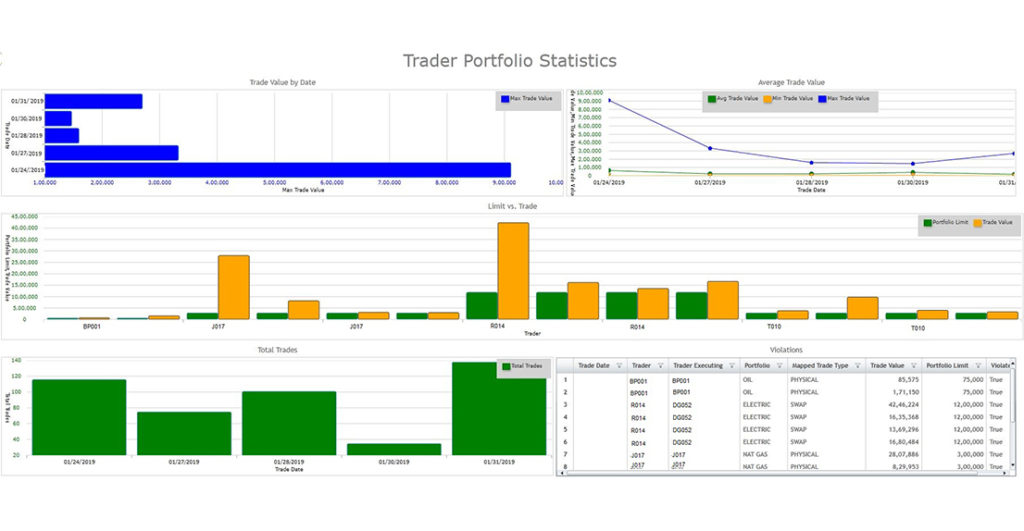

Trader Limit Violations

The Trader Limit Violation report shows a snapshot view of all trade violations during the day as defined in the risk policy. It includes per trade volume, dollar value, term, duration, aggregate value and volume limits done during the day. You can drill down to the trade-level data to get full insight into the violations and individually track the transactions.

Trade Compliance Solutions by EPIC

- Three categories of wash detection – exact match, tolerance-based match and potential wash trades

- Customize business rules as your journal entry requirements

- Generate automated reports in the desired formats

- Feed to your GL systems without directly interacting to them

- Shows nearly all the flows of money, into and out of, the U.S for purchases and sales of U.S. Securities and financial instruments

- Reports purchases and sales of long-term securities by foreign-residents

- Monitoring of volume, dollar value, term, duration and aggregate value limits against new and updated trades done during a day

- Monitoring can be done EOD or multiple times a day

- Automatic emails are generated to traders and their managers for trade violations

- Historical limit maintenance of trader limits for future reference

- Allow market participants to exploit arbitrage opportunities arising when day-ahead electricity prices are predictably higher or lower than expected real-time prices

- Unprofitable virtual transactions like FTR are used to enhance value of related positions

- Our model studies the cross-product manipulation and evaluates its effects on price convergence and other market outcomes using numerical simulations

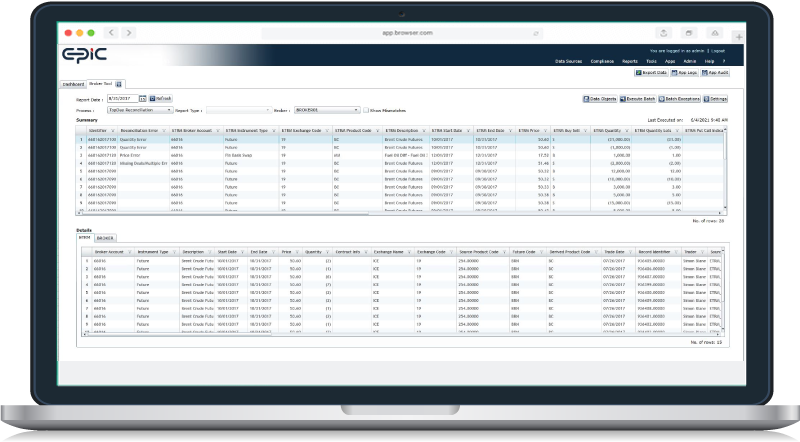

- Pull transactions to be reported by self and the respective counterparties

- Ability to download SDR data using external adapters

- Reconcile transactions to be reported by counterparty with the SDR download

- Calculate gross effective notional amount for rolling 12-month transactions

- Capture violations on notional volume against configurable thresholds

- Easily reconcile the data coming from various sources and store it into centralized database

- Perform custom checks on parameters like price, quantity and others.

- Capture and store data from FCM firms provided in the form of CSV, and Excel files and perform account-level reconciliation

- Generate “EOD position & trade reconciliation,” “fee reconciliation” and “intraday reconciliation”

- Get the custom UI app to view the side-by-side comparison for all reconciliations.

- Date variance report

- Trader not equal to book owner

- Day 1 gain/loss reporting

- End of day monitoring with violation emails being sent to traders and their respective managers

Plug n Play Apps

Purpose-built apps to support critical business functions from day one.